Health Insurance

FIND AN AFFORDABLE HEALTH CARE PLAN TODAY

-Predictable

-Set payments

-Know exactly what your plan will pay for office visits, lab tests,

hospitalization and more

-Adult and child options Coverage eligibility for all ages, 65 and under; child-only plans available

-Rx Prescription drug coverage is included in most plans

-Flexibility

-We have access to all the major Network providers

HAVE QUESTIONS? CALL NOW FOR HELP 855-487-6714

Aetna Select Health U of U Health Molina Cigna Regence

Whether you are looking for a Major Medical that is for emergency only a HSA or Platinum Plan with all the extras, you will see all the carriers and plans based on your zip code as you shop for the best plan for you and your family.

YOUR MONTHLY PREMIUM SAVINGS

$210/MO *example

You also qualify for

Cost Sharing Reduction

Instant Savings

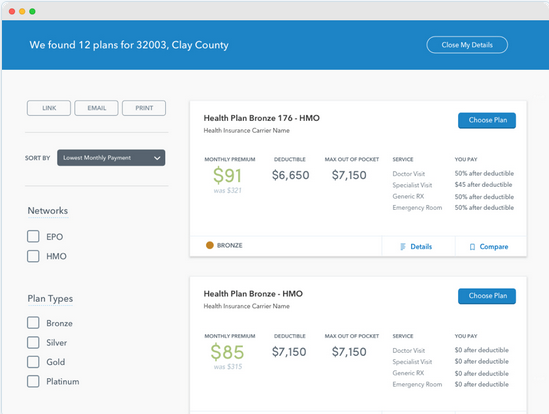

Quickly see what kind of savings you qualify for under the Affordable Care Act without ever having to sign up.

Easy plan shopping

Browse and compare plans based on what matters to you most.

Support & Consultation

If you need help understanding your options, enrolling, or managing your plan, we're here for you.

Different types of Major Medical plans

There are several types of major medical plans that offer different levels of coverage and cost-sharing. Here are some common types of major medical plans:

- Preferred Provider Organization (PPO) Plan: PPO plans provide access to a network of healthcare providers at discounted rates. You can choose to see providers outside of the network, but you will typically pay more out-of-pocket for these services.

- Health Maintenance Organization (HMO) Plan: HMO plans typically have a more limited network of providers, and you generally need to choose a primary care physician who coordinates all of your care. You usually need a referral to see a specialist.

- Point of Service (POS) Plan: POS plans combine features of both PPO and HMO plans. You have the option to see providers outside of the network, but you will typically pay more out-of-pocket for these services. You also need to choose a primary care physician who coordinates your care.

- High Deductible Health Plan (HDHP): HDHPs have lower premiums but higher deductibles than other types of plans. You need to pay for most healthcare services out-of-pocket until you reach your deductible. After that, your plan will typically cover a higher percentage of your healthcare costs.

- Catastrophic Plan: Catastrophic plans are designed to provide coverage in case of a major medical event, such as a serious illness or injury. They typically have very high deductibles and low premiums, and you need to pay for most healthcare services out-of-pocket until you reach your deductible.

- Exclusive Provider Organization (EPO) Plan: EPO plans are similar to PPO plans but have a more limited network of providers. You generally need to choose a primary care physician who coordinates your care, and you may need a referral to see a specialist.

It's important to review and understand the specifics of each plan before choosing the best option for you. Consider your healthcare needs, budget, and preferences when making your decision.

Health Savings Account (HSA)

-A Health Savings Account (HSA) Personal Health Plan is a type of major medical plan that allows you to save money tax-free to pay for qualified medical expenses. This type of plan typically has a high deductible, meaning you will have to pay for most healthcare services out-of-pocket until you reach your deductible. However, once you reach your deductible, your plan will typically cover a higher percentage of your healthcare costs.

The money you contribute to your HSA is tax-deductible, and any interest or investment gains earned on the account are tax-free. You can use the funds in your HSA to pay for qualified medical expenses, including deductibles, copayments, and prescriptions. Some plans also allow you to use HSA funds for certain alternative healthcare services, such as acupuncture or chiropractic care.

-In order to open an HSA, you must be enrolled in a high-deductible health plan (HDHP) that meets certain requirements set by the IRS. You can contribute to your HSA up to a certain limit each year, which is also set by the IRS. Some employers may also contribute to your HSA on your behalf.

-One advantage of an HSA Personal Health Plan is that it can provide tax benefits and help you save for future healthcare expenses. However, it's important to note that not all medical expenses are eligible for HSA reimbursement, and you may still be responsible for paying for certain services out-of-pocket. Additionally, you must use HSA funds for qualified medical expenses, or you may face a tax penalty.

-It's important to review the specifics of each HSA Personal Health Plan before choosing the best option for you. Consider your healthcare needs, budget, and preferences when making your decision, and be sure to read the fine print to understand what is and is not covered by your plan.

Personal Plan designs

Copay Personal medical Plan

-A copay personal medical plan is a type of major medical plan that requires you to pay a fixed amount, known as a copayment or copay, for each medical service you receive. The copay amount is predetermined by your insurance plan and can vary depending on the service you receive. Copay personal medical plans typically have higher monthly premiums than other plans, but they can provide more predictable out-of-pocket costs.

Health Savings Account (HSA)

-A Health Savings Account (HSA) Personal Health Plan is a type of major medical plan that allows you to save money tax-free to pay for qualified medical expenses. This type of plan typically has a high deductible, meaning you will have to pay for most healthcare services out-of-pocket until you reach your deductible. However, once you reach your deductible, your plan will typically cover a higher percentage of your healthcare costs.